What is a Performance Bonds PB.

A performance bond, also known as a contract bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. The term is also used to denote a collateral deposit of good faith money, intended to secure a futures contract, commonly known as margin.

https://en.wikipedia.org/wiki/Performance_bond

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract. It is also referred to as a contract bond. A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

https://www.investopedia.com/terms/p/performancebond.asp

A bond issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract.

For example, a contractor may issue a bond to a client for whom a building is being constructed. If the contractor fails to construct the building according to the specifications laid out by the contract, the client is guaranteed compensation for any monetary loss.

Understanding Performance Bonds.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract. … A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

A performance bond is a type of surety bond contract between a contractor, a surety, and owner. As principal, the contractor must obtain the bond. As obligee, the owner requires the bond protection. The surety company is the party that backs the bond financially but is only liable for the total amount of the bond. The bond ensures legal and financial protection for those involved in a construction project. This contract is a guarantee that the contractor will complete the project including its conditions, cost, and time period as agreed.

Performance bonds are common in construction and real estate development. In such situations, an owner or investor may require the developer to assure that contractors or project managers procure performance bonds, in order to guarantee that the value of the work will not be lost in the case of an unforeseen negative event.

Important: Performance bonds are also used in commodity contracts.

How Does a Performance Bond Work?

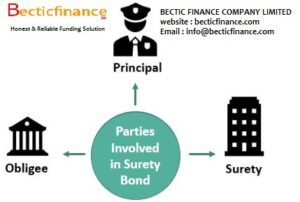

With a performance bond, there are generally three party agreements as outlined below:

1. Principal – The primary person or business entity who will be performing a contractual obligation.

2. Obligee – The party that is the recipient of the obligation.

3. Surety – The party that ensures (guarantees) that the principal’s obligations will be performed. Sureties are similar to (sometimes divisions of) insurance companies.

Example of Performance Bonds: For example, a client issues a contractor a performance bond. If the contractor is not able to follow the agreed specifications in constructing the building, the client is given monetary compensation for the losses and damages the contractor may have caused.

Key Takeaways

* A performance bond is a financial instrument, ensuring the investor that the contractor will fulfill its obligations outlined in a contract. The investor may also get compensated for any losses or damages incurred due to the project failure.

* They consist of three parties or entities – the principal (contractor), the obligee (customer), and the surety (financial institution).

* These are common in the construction and real estate industries working for government-related or private sector projects.

* The cost of surety bonds is typically equivalent to 1% of the value of the contract. However, this rate can vary depending on the financial stability of a business.

Types of Performance Surety Bonds: While these bonds are often referred to as Contract Bonds, the most common types are.

* Performance bonds

* Payment bonds

* Maintenance bonds

* Subdivision bonds

Bond Liability.

If the contractor is unable to perform his duties as agreed, the surety becomes responsible for the bond. The surety will pay the full penalty amount and other damages incurred when a contractor fails to complete the project

Benefits of Performance Bonds.

The most obvious benefit of a performance bond for the owner is the assurance of a project’s completion. The surety protects the owner in the event the contractor defaults on the contract. Contractors are taken through a meticulous pre-qualification process

.

Disadvantages of Performance Bonds.

For one, the surety may not have to owner’s best interest in mind. A surety may accuse an owner of not complying with a bond agreement to avoid paying the owner. Another disadvantage is underestimating losses which means getting less money from a surety to complete the project.

Who Can Get a Performance Bond?

In order to get a performance bond, contractors must usually pay a premium on the bond amount as well as interest on the bond. Again, the price will depend on the cost of the bond and the risk (creditworthiness) the principal presents. In most cases, you will first need to obtain a bid bond before bidding on a project.

How to Apply for a Performance Bond?

Contact Bectic Finance Company Limited for more information. Apply today if you need a Performance Bond at At Bectic Finance Company Limited website : becticfinance.com

Email : info@becticfinance.com

How Much Does a Performance Bond Cost?

Expect to pay a small percentage of the bond total. The exact bond cost depends on the applicant’s credit and history with bonding. Applicants who have a higher credit score and have never had a claim filed against a bond will pay a lower percentage of the total. Applicants with credit scores below 700, a blemish like bankruptcy on their financial record, or a previous claim on a bond (performance or otherwise) will pay a higher percentage. If you’re simply curious how much a performance bond would cost you, contact us and we can give you a general idea of how much bonding would cost for your specific situation.

Performance Bonds at Bectic Finance Company Limited. Contact our Contract Bond experts today for consultation.

At Bectic Finance Company Limited, we provide Bank and Financial instrument services to our clients global- UK, USA, UAE, Europe, India, China, Asia, Middle East and Africa.

Contact Bectic Finance Company Limited with your request via email and we will provide you with our forms and procedures.

For more information, please contact us:

BECTIC FINANCE COMPANY LIMITED

website : becticfinance.com

Email : info@becticfinance.com

Recent Comments